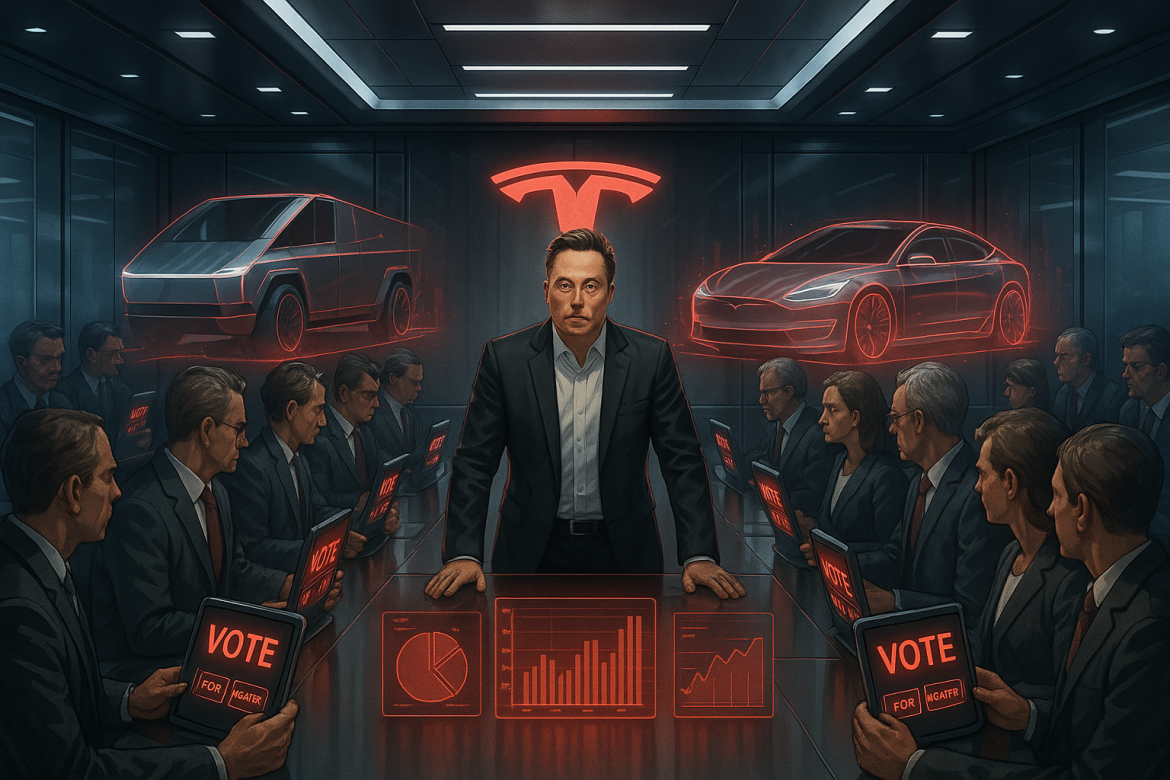

The fight over Elon Musk’s unprecedented $1 trillion pay package is intensifying ahead of Tesla’s annual shareholder meeting on November 6 in Austin, Texas.

With the potential to make Musk the world’s first trillionaire, the 10-year compensation plan has divided some of Tesla’s largest investors, pension funds, and advisory firms, underscoring the tension between rewarding performance and curbing corporate concentration of power.

Tesla Chair Robyn Denholm has warned shareholders that Musk may consider leaving the company if the package fails to pass, while the CEO himself has spent recent weeks publicly lobbying investors to approve the deal.

The proposal, touted by the board as “the largest corporate pay package in history”, would grant Musk massive stock-based incentives if he meets a series of ambitious financial and product milestones.

Shareholders who back Musk’s pay package

Cathie Wood’s ARK Invest

Cathie Wood, CEO of ARK Invest and one of Musk’s most vocal supporters on Wall Street, has backed the plan.

Wood, earlier this month said she was confident the package would pass and argued that it could propel Tesla toward “super-exponential growth.”

Tesla remains the largest holding in ARK’s portfolio, valued at around $1 billion, underscoring Wood’s long-term faith in Musk’s leadership and the company’s AI-driven future.

State Board of Administration of Florida

The State Board of Administration of Florida, which manages over $280 billion in assets and holds more than $1 billion worth of Tesla shares, announced its support for the proposal earlier this week.

Chaired by Florida Governor Ron DeSantis, the board described the 2025 CEO performance award as a “bold, performance-driven incentive structure,” emphasizing its alignment with shareholder interests.

Atreides Management

Gavin Baker, managing partner at Boston-based Atreides Management, also voiced support on social media platform X.

Baker said his firm, holder of more than 321,000 Tesla shares worth approximately $141 million as of June 2025, would vote in favor of the proposal.

“Elon’s involvement is integral to maintaining Tesla’s current course and trajectory,” he said, adding that he would prefer similar performance-linked pay structures at all companies Atreides invests in.

Wedbush Securities

Dan Ives, managing director at Wedbush Securities and a long-time Tesla bull, has likewise thrown his support behind Musk’s pay plan.

In a research note, Ives wrote that the proposed package would help keep Musk focused on Tesla’s “autonomous and robotics future,” which he views as critical to the company’s long-term success.

Investors and institutions who are opposing the plan

New York State retirement fund

New York State Comptroller Thomas DiNapoli urged fellow shareholders to reject the plan, citing an “alarming lack of board independence.”

DiNapoli, who controls roughly 3.3 million Tesla shares through the state’s pension system, called the proposed award “pay for unchecked power,” arguing that Musk’s compensation would further concentrate control in one individual.

“The idea that another massive equity award will somehow refocus a man who is distracted is both illogical and contrary to the evidence,” DiNapoli wrote.

California Public Employees’ Retirement System (CalPERS)

CalPERS, the largest public pension fund in the US, also announced it would vote against the package.

The fund’s global equities investment director, Drew Hambly, said in a statement that the plan “is larger than pay packages for CEOs in comparable companies by many orders of magnitude” and “would further concentrate power in a single shareholder.”

CalPERS holds about 5 million Tesla shares, making it one of the company’s most influential institutional investors.

American Federation of Teachers

The American Federation of Teachers (AFT), the nation’s second-largest teachers’ union, joined several other unions and advocacy groups in urging shareholders to reject the plan.

The AFT argued that the package fails to secure commitments ensuring Musk remains focused on Tesla, instead of his other ventures or political pursuits.

Proxy Advisory firms ISS and Glass Lewis

Two of the most influential proxy advisory firms, Institutional Shareholder Services (ISS) and Glass Lewis, have both recommended that shareholders vote against the proposal.

Glass Lewis cited “significant concerns” about the plan’s potential to dilute shareholder value and questioned the board’s independence.

Tesla responded sharply, accusing the firms of applying “one-size-fits-all checklists” and ignoring the company’s record financial results under Musk’s leadership.

Musk, in response, lashed out at both firms during Tesla’s latest earnings call, calling them “corporate terrorists” and claiming their past recommendations “would have been extremely destructive to Tesla’s future.”

A divisive vote with high stakes

With the November 6 vote approaching, the battle over Musk’s compensation has become one of the most closely watched corporate governance fights in recent memory.

Supporters say the plan ties Musk’s incentives directly to shareholder value creation and ensures his continued leadership, while critics warn it risks undermining accountability and corporate balance.

Analysts expect the company to pass the vote, granting Musk the unprecedented pay package.

Tesla’s board in the past has granted Musk grand compensation, although it faces legal scrutiny now.

The board had passed $56 billion package in 2018.

The Delaware Court of Chancery in 2024 ruled that the package was granted unfairly.

Musk had appealed the decision.

The post Battle lines drawn as Tesla shareholders prepare to vote on Elon Musk’s $1T pay package appeared first on Invezz